Directors’ Report 2021

2021 was a solid year for the Group and KONGSBERG enters 2022 with a strong order backlog of nearly NOK 50 billion and strong market positions. In 2021, the COVID-19 pandemic also had a significant effect on both working methods and processes. Despite the uncertainty and challenges caused by the pandemic, the company has maintained good operations and project implementation while securing a significant new order intake. Both Kongsberg Maritime and Kongsberg Defence & Aerospace improved their profitability and order intake. Kongsberg Digital has increased the number of dynamic digital twins in operation and also onboarded a number of new customers for its Vessel Insight solution. Overall, KONGSBERG performed well in 2021 and has a solid foundation for further growth.

Kongsberg Gruppen (KONGSBERG) is an international technology group. We deliver advanced, sustainable and reliable high-tech solutions that help ensure secure, safe, efficient and environmentally friendly operations. KONGSBERG has customers in the global defence, maritime, energy, fisheries and aerospace sectors.

Sustainable innovation is an integral part of KONGSBERG’s business strategy. Our biggest contribution to achieving both our own and internationally established sustainability goals is through the delivery of high-tech products and services to reduce our customers’ climate footprint.

|

KONGSBERG

|

KONGSBERG

|

|

|---|---|---|

|

Headquarter

|

Headquarter

|

Kongsberg

|

|

Number of employees

|

Number of employees

|

11 122

|

|

Share of employees outside Norway

|

Share of employees outside Norway

|

37%

|

|

Number of countries with presence

|

Number of countries with presence

|

37

|

|

Share of revenues outside Norway

|

Share of revenues outside Norway

|

81%

|

Operating revenues increased by 7 per cent compared to 2020, to MNOK 27,449. Kongsberg Maritime (KM) had operating revenues of MNOK 16,507, Kongsberg Defence & Aerospace (KDA) had operating revenues of MNOK 10,078 and Kongsberg Digital (KDI) had operating revenues of MNOK 845. The Group’s order backlog increased from MNOK 35,947 at the end of 2020 to MNOK 49,535 at the end of 2021. KM’s order backlog increased by NOK 1.6 billion, KDA’s order backlog increased by just over NOK 12 billion and KDI’s order backlog was practically unchanged over the year. In total, the Group’s order intake of MNOK 40,979 was up on MNOK 28,818 in 2020. The book-to-bill ratio was 1.49. EBITDA increased by MNOK 836 to MNOK 4,086 in 2021. Both KM and KDA had an increase in EBITDA, while KDI’s EBITDA went down as a result of the ongoing scaling of the business. Strong project implementation and cost discipline contributed to a solid profitability.

Profit for the year after tax in 2021 amounted to MNOK 2,290 compared to MNOK 1,481 from continuing operations the previous year, corresponding to NOK 12.06 per share (NOK 8.01). The Group had a positive cash flow of MNOK 697 in 2021 (MNOK 1,766) and had net interest-bearing debt of MNOK -5,668 (MNOK -3,949) at the end of the year. At the end of the year, Group equity was MNOK 13,618 (MNOK 13,301).

1) Figures in the income statement, orderintake and order backlog for 2019 and 2018 are adjusted for discontinued operations. Comparable figures earlier years are not adjusted.

2) From 2020 onwards profit shares are not longer included in EBITDA and EBIT. Compareable figures are adjusted.

KONGSBERG has a solid financial position and based on this the Board of Directors will propose to the Annual General Meeting on 11 May 2022 a dividend of NOK 15.30 per share (a total of MNOK 2,736) of which NOK 3.30 is part of the Groups ordinary dividend policy and NOK 12.00 is in addition. In addition, a buy-back program of shares for cancellation, of up to MNOK 500, will be proposed. Total remuneration to shareholders will amount to approximately MNOK 3,200, which corresponds to around NOK 18.10 per share.

Business areas

Kongsberg Defence & Aerospace

|

MNOK

|

MNOK

|

2021

|

2020

|

|---|---|---|---|

|

|

|

|

|

|

Operating revenues

|

Operating revenues

|

10 078

|

8 503

|

|

EBITDA

|

EBITDA

|

2 150

|

1 656

|

|

EBITDA margin

|

EBITDA margin

|

21.3%

|

19.5%

|

|

Order intake

|

Order intake

|

22 221

|

11 891

|

|

Order backlog

|

Order backlog

|

35 632

|

23 477

|

KDA had operating revenues of MNOK 10,078 in 2021, MNOK 1,575 higher than in 2020. The EBITDA margin as of 31.12.21 was 21.3 per cent, compared to 19.5 per cent in 2020. All divisions achieved growth in terms of both operating revenues and EBITDA during the year. The order backlog increased from MNOK 23,477 at the end of 2020 to MNOK 35,632 at the end of 2021, of which 73 per cent comprised deliveries outside Norway. The strong order backlog will provide a good basis for increased growth in operating revenues in the future.

The Integrated Defence Systems (IDS) division increased its operating revenues of almost 30 per cent and was the KDA division with the highest operating revenues in 2021. IDS supplies systems including the NASAMS air defence system, submarine combat systems and digital solutions for military vehicles. The increase in turnover was mainly driven by large NASAMS contracts signed in recent years. In 2021, KDA signed a contract for the delivery of a combat system for new Norwegian and German submarines to be built in Germany. This contract can be characterized as a breakthrough for an initiative that has been engaged for many years and is proof of the long-term dedication by the defence industry. The agreement will provide operating revenues well into the 2030s and will both provide volume and be of long-term importance for KONGSBERG and a number of local and national subcontractors.

The Land Systems division, which supplies remote weapon stations (RWS) and communications equipment, achieved increased growth in 2021 and was KDA’s second-largest division in terms of operating revenues. The division’s largest customer is the US Army for which, through the US CROWS programme, KDA has been the main RWS supplier since 2007. In 2021, KDA signed a MUSD 500 extension of the existing CROWS IV framework agreement, originally signed in 2018. KDA also signed a framework agreement worth up to MUSD 94 in 2021 for delivery of RWS with 30 mm cannons as part of a new air defence system known as MADIS (Marine Air Defense Integrated System). KDA has currently delivered approximately 21,000 weapon stations to 28 nations.

Through its Aerostructures division, KONGSBERG has supplied advanced composite and titanium aircraft parts for the F-35 combat aircraft since 2008. Delivery volumes have increased every year. From producing a few parts in the first few years, the programme is now in full production. Kongsberg Aviation Maintenance Services (KAMS), formerly AIM Norway, is part of the Aerostructures division. The company was acquired and integrated in 2019. KAMS has performed well since the company became part of KONGSBERG and increased its turnover by more than 25 per cent in 2021 compared to the previous year. The company is an important part of KDA’s commitment to upgrading and maintenance, and in 2021 KAMS signed upgrade agreements relating to the Norwegian F-16 aircraft for resale. A maintenance agreement was also signed for the Norwegian AW101 rescue helicopters, and KAMS was also authorised as a maintenance supplier for the Norwegian Air Force’s fleet of Bell 412 helicopters. KAMS is continuously working on further developing its strategic cooperation with the Norwegian Armed Forces and is well positioned for continued growth in the years to come.

The Missile Systems division had increased growth and accounted for almost half of KDA’s order intake in 2021. The Naval Strike Missile (NSM) and the Joint Strike Missile (JSM) are the main products in the division. These long-range high-precision missiles are world-leading with their 5th generation low-signature design. Missile Systems signed contracts for both the delivery of new NSMs and the maintenance of existing NSMs with Norway, Germany and Poland in 2021. The division also signed a significant supply contract for JSMs for the Norwegian F-35 fleet towards the end of the year. KONGSBERG now has contracts with both Japan, which was the first country to order JSMs, and Norway for missile deliveries. Over the coming years, further increases in activity levels are expected for both JSM and NSM as a result of demand for this type of capacity from many countries.

Through its Space & Surveillance (DSS) division and the Kongsberg Satellite Services (KSAT) joint venture, KONGSBERG is the Nordic region’s largest supplier of equipment and services to the aerospace industry. Space is an important focus area for KDA and significant investments were made in the area during 2021.

A number of important satellite launches had KONGSBERG equipment on board in 2021, including Galileo satellite numbers 27 and 28, which were launched in December. Another prestigious project bringing success for the division was when NASA completed its landing on Mars on 18 January 2021. The vehicle that landed on the planet was equipped with important electronics from KONGSBERG.

The defence business has not experienced major economic consequences as a result of COVID-19. Project progress has been affected by the situation to a minor extent despite some challenges with the movement of staff across borders. In addition, certain contract negotiations have proved somewhat more time-consuming due to travel restrictions.

A lack of individual components affected many companies in 2021. KDA depends on supplies from several hundred subcontractors both in Norway and abroad. The component situation is being closely monitored and additional resources were introduced early in the pandemic to ensure the flow of goods, consignments and alternative subcontractors to avoid delays in production. The business area did not experience significant delays related to component shortages in 2021, but was affected by somewhat increased prices and longer lead times for certain components. The situation and developments will be closely monitored in 2022 and measures initiated on a continuous basis.

Investing in defence programmes is an extensive and time-consuming process. The customers for large defence systems are national authorities in the respective countries. These customers consider national security and domestic economic development as significant factors, in addition to price and performance, when purchasing defence equipment. National budgets and policies will therefore have a strong impact on whether and when any contract can be entered into with KONGSBERG. The market is not subject to international free trade agreements and is characterised more by national protectionism than is seen in most other industries. Predictability in the export regulations with respect to defence material and the application of the regulations is therefore an important framework condition for KONGSBERG.

It is important for the Norwegian defence industry that the Norwegian authorities’ emphasis is on repurchase agreements and agreements that secure market access in connection with purchase of defence equipment from abroad. When the Norwegian Armed Forces make significant investments through foreign suppliers, this often ties up a significant proportion of the defence budget. To ensure that military supplies are well adapted to Norwegian conditions and to guarantee a sustainable and competitive Norwegian defence industry, we emphasise the importance of Norwegian participation in such programmes. Both the Government and the Parliament have stressed the importance of industrial participation for Norwegian industry, and that this is in line with international practice. KONGSBERG will continue to emphasise partnerships with major defence contractors and continue to support the local industry in the business area’s markets further. KONGSBERG’s position as an attractive defence supplier in the international market will continue to be based on close cooperation with the Norwegian Armed Forces. This cooperation forms the platform for the development of leading products that are essential for any modern defence system. Such participation also means increased activity for many of the business area’s approximately 1,500 Norwegian subcontractors.

Kongsberg Maritime

|

MNOK

|

MNOK

|

2021

|

2020

|

|---|---|---|---|

|

|

|

|

|

|

Operating revenues

|

Operating revenues

|

16 507

|

16 319

|

|

EBITDA

|

EBITDA

|

1 977

|

1 532

|

|

EBITDA margin

|

EBITDA margin

|

12.0%

|

9.4%

|

|

Order intake

|

Order intake

|

17 936

|

15 925

|

|

Order backlog

|

Order backlog

|

13 023

|

11 386

|

In 2021, operating revenues amounted to MNOK 16,507, up from MNOK 16,319 in 2020. EBITDA in 2021 amounted to MNOK 1,977, while the EBITDA margin was 12.0 per cent compared with MNOK 1,532 (9.4 per cent) in 2020. Order intake during 2021 amounted to MNOK 17,936, equivalent to a book-to-bill ratio of 1.09. The order intake was up MNOK 2,011 from 2020. KM has diversified exposure and delivers equipment and solutions for most maritime vessel segments, such as traditional transport vessels, offshore, fishing, research, passenger ships and marine robotics. This makes the business area less vulnerable to fluctuations in individual segments.

At the outbreak of the ongoing pandemic in the winter/spring of 2020, a number of measures were quickly implemented to limit the infection, maintain as normal a level of operations as possible and ensure that cost levels were adapted to the level of activity. The results KM has delivered throughout the pandemic would not have been possible without the measures taken. KM has employees in 34 countries and operations around the world, which means that measures have varied considerably in line with the restrictions enacted in individual regions. Our global presence has proven to be important in delivering projects as well as performing service assignments during the pandemic, as travel restrictions have posed a major challenge.

Contracting of new vessels picked up in 2021 compared to the previous year. This resulted in KM having a higher order intake from the new-build market. In the order intake from the new-build market in 2021, three vessel segments can be highlighted: offshore wind, naval and towing vessels (tugs). KM has established itself as a leading supplier of systems to these markets. Order intake was over NOK 1 billion throughout the course of the year from all three market segments. KM’s two largest orders signed in 2021 came from the offshore wind segment. These included significant deliveries of equipment for three wind turbine installation vessels, two of which will be built for the Danish company Cadeler and one for US-based Dominion Energy.

As part of the acquisition of Rolls-Royce Commercial Marine (CM), a comprehensive programme was launched to realise cost and sales synergies. The cost synergies realised since the acquisition have been a key factor behind KM’s improved margins in recent years. Sales synergies (cross-selling) were also a major factor in 2021. A large part of the rationale behind KONGSBERG’s acquisition of CM in 2019 was the complementary product and market portfolio between the two companies.

In 2021, cross-sales totalling NOK 1.1 billion were made to the new-build market, as well as cross-sales to the aftermarket. Overall, cross-sales of NOK 2 billion have been completed since the acquisition. This only includes additional sales as a result of the integration of CM and KM. Around MNOK 500 of the additional sales were related to offshore wind projects. The remainder was distributed between most of the vessel categories that KM supplies, such as tankers, research vessels, LNG, ferries and other traditional merchant marine vessels.

KM has, through its Sensors & Robotics division, a portfolio of sensors and sensor solutions that are central to mapping, monitoring and understanding the ocean environment. This contributes to the safe and reliable management of operations both on and below the surface of the sea. The demand for this type of system does not directly correlate with the traditional vessel market, but is driven by demand from segments such as research and fishing, and also offshore operations related to both traditional offshore oil and gas as well as renewable energy. Despite a relatively modest increase in operating revenues in 2021 compared with 2020, order intake in this area increased by approximately 15 per cent. There is a strong demand for solutions related to ocean environment monitoring.

KM has a well-established aftermarket network supporting more than 30,000 vessels fitted with KM equipment. KM’s significant activity here is the result of several decades of rolling out KM products and systems. One new sale creates aftermarket activity for the next 20–30 years and good aftermarket work during this period can again lead to new sales at a later date. The relationship between new builds and the aftermarket is, therefore, extremely important. In 2021, the aftermarket accounted for approximately half of KM’s revenues and order intake.

With new regulations and a significantly greater focus on sustainability in the market in general, the demand for environmentally friendly solutions is increasing. KM has relatively low emissions from its own operations, but at the same time supplies industries that have historically been responsible for significant emissions and are facing a major transition. One of the most important objectives with KM’s deliveries is to streamline and secure customer operations. In addition to ambitions to reduce the climate footprint from its own operations, it is therefore important to work with customers to develop new and more environmentally friendly products and solutions. Here, the technologies within the business area can really make a difference. In 2021, KM launched a system using hydrogen as an energy carrier for the propulsion of vessels. The system will be installed on a hydrogen-powered passenger ferry that will run between Kirkwall and Shapinsay in Orkney.

The Norwegian maritime and offshore industry is important for the export industry. The Board therefore emphasises the need for a governmental industrial policy promoting growth and development in this sector, including competitive conditions and financing solutions.

Kongsberg Digital

|

MNOK

|

MNOK

|

2021

|

2020

|

|---|---|---|---|

|

|

|

|

|

|

Operating revenues

|

Operating revenues

|

845

|

821

|

|

Recurring revenues

|

Recurring revenues

|

347

|

278

|

|

EBITDA

|

EBITDA

|

(45)

|

34

|

|

Order intake

|

Order intake

|

789

|

997

|

|

Order backlog

|

Order backlog

|

932

|

977

|

In 2021, operating revenues amounted to MNOK 845, up from MNOK 821 in 2020. Recurring revenues were 41 per cent of operating revenues. EBITDA for the year was negative in the amount of MNOK 45. KONGSBERG has major growth ambitions for KDI. Throughout 2021, KDI further strengthened its organisation with both software developers and commercial resources, and invested significantly in the deployment of new solutions and applications. This affected KDI’s operating profits for 2021, and it is expected that this will also apply in 2022.

KDI was established in 2016 as an important step in the development of the next generation of digitalised products and services within our core areas. Demand for our digital twin solution Kognitwin and the “ship-to-cloud” solution Vessel Insight increased in 2021. By the end of the year, KDI had signed Vessel Insight agreements for around 1,100 vessels. More than 60 shipowners now use Vessel Insight on all or part of their fleet. In total, these shipowners control more than 2,750 vessels, representing considerable potential for additional sales.

Since its establishment, important steps have also been made with the business area’s dynamic digital twin Kognitwin Energy. Since the first contract was signed with Shell in the autumn of 2019, both the number of installations and the number of users have increased considerably. By the end of the year, KDI had eight digital twins in operation, with about 1,700 users, representing an increase of 1,300 users in 2021. KDI also has a number of ongoing “proof of concept” (POC) agreements under which customers test and evaluate Kognitwin on individual installations.

The Maritime Simulation area accounted for about 35 per cent of KDI’s operating revenues in 2021 but saw an overall decrease in operating revenues compared with 2020. However, order intake for the area was 19 per cent higher than last year and developments, particularly in the second half of the year, were positive. In 2021, the business area saw increased use of the K-SIM Connect application-based solution, which allows users to access the solutions from their own PCs and tablets.

The phase that KDI now finds itself in means that it is natural to assess both future partner models and other models in order to fully realise the potential that KONGSBERG sees in KDI, including a stock exchange listing.

Comments to the financial statements

Operating revenues

The Group’s operating revenues in 2021 amounted to MNOK 27,449, up 7 per cent from MNOK 25,612 in 2020. KM had operating revenues of MNOK 16,507, while KDA had operating revenues of MNOK 10,078 in 2021.

Distribution of revenue

Per cent- Kongsberg Maritime 60 %

- Kongsberg Defence & Aerospace 37 %

- Other activities 3 %

EBITDA development

EBITDA was MNOK 4,086 in 2021, with an EBITDA margin of 14.9 per cent, compared to MNOK 3,250 in 2020. KDA increased its EBITDA from MNOK 1,656 to MNOK 2,150 between 2020 and 2021, while KM increased its EBITDA from MNOK 1,532 to MNOK 1,977.

Performance

Earnings before tax were MNOK 2,922, compared with MNOK 1,855 in 2020. Profit after tax from continuing operations was MNOK 2,290, equivalent to NOK 12.06 per share in 2021, compared to MNOK 1,481 in 2020. Profit after tax, including divested operations, was MNOK 2,290 in 2021, corresponding to NOK 12.06 per share, against MNOK 2,932 in 2020. Return on average capital employed (ROACE) was 32.7 per cent in 2021 (20.8 per cent in 2020).

The Board of Directors will propose a dividend of NOK 15.30 per share to the Annual General Meeting on 11 May 2022 (MNOK 2,700 in total) of which NOK 3.30 is part of the Groups ordinary dividend policy and NOK 12.00 is in addition. In addition, a buy-back program for cancellation, totalling MNOK 500, will be proposed. Total remuneration to shareholders will then amount approximately MNOK 3,200, which corresponds to NOK 18.30 per share. The equivalent dividend in 2021 was NOK 8.00 per share, a total of MNOK 1,440, of which NOK 5.00 per share was in addition to the Group’s ordinary dividend. A buy-back programme for treasury shares for cancellation was also initiated, for up to MNOK 400. As of 31 December 2021, 592,028 of these shares had been bought back for a total of MNOK 153. The number of outstanding shares, including shares owned by KONGSBERG, was 178,833,446 as of 31 December 2021.

|

MNOK |

MNOK |

KONGSBERG

consolidated |

Kongsberg

Defence & Aerospace |

Kongsberg

Maritime |

Other/

eliminations |

|---|---|---|---|---|---|

|

|

|

|

|

|

|

|

OPERATING REVENUES |

OPERATING REVENUES |

|

|

|

|

|

2021

|

2 021

|

27 449

|

10 078

|

16 507

|

864

|

|

2020

|

2 020

|

25 612

|

8 503

|

16 319

|

790

|

|

EBITDA |

EBITDA |

|

|

|

|

|

2021

|

2 021

|

4 086

|

2 150

|

1 977

|

(41)

|

|

2020

|

2 020

|

3 250

|

1 656

|

1 532

|

62

|

|

EBITDA MARGIN |

EBITDA MARGIN |

|

|

|

|

|

2021

|

2 021

|

14.9%

|

21.3%

|

12.0%

|

(4.7%)

|

|

2020

|

2 020

|

12.7%

|

19.5%

|

9.4%

|

7.8%

|

|

NEW ORDERS |

NEW ORDERS |

|

|

|

|

|

2021

|

2 021

|

40 979

|

22 221

|

17 936

|

822

|

|

2020

|

2 020

|

28 818

|

11 891

|

15 925

|

1 002

|

Cash flow

KONGSBERG had a positive cash flow from operational activities of MNOK 4,970 (MNOK 2,751) in 2021. This mainly consists of EBITDA of MNOK 4,086, adjusted for changes in current assets and other operating items.

In 2021, there was a negative cash flow related to investment activities of MNOK 698 (MNOK +2,392). The sale of the American subsidiary Hydroid Inc. contributed MNOK 3,040 in 2020. The largest outgoing cash flows related to investment activities are MNOK 555 related to the purchase/sale of property, plant and equipment, and MNOK 215 related to capitalised development.

Cash flow from financing activities was negative in the amount of MNOK 3,490 (MNOK 3,474), mainly related to dividends paid, debt repayments and interest expenses.

Net change in cash and cash equivalents, after the effect of exchange rate changes, was MNOK 697 (MNOK 1,766).

Capital structure

The most important priority for capital allocation for KONGSBERG is having a healthy balance through ensuring that net debt is on a par with EBITDA as a long-term mean, subject to the condition that net debt does not exceed twice EBITDA. This ensures a balance between creditor and shareholder, and offers security for KONGSBERG’s suppliers and customers. This is important because KONGSBERG is involved in deliveries which extend over many years.

The priorities as regards capital allocation also take into account the company’s dividend policy and are explained in more detail in Note 5 in the annual report. As of 31 December 2021, KONGSBERG’s ratio for net debt/EBITDA was -1.6.

The Group’s equity as of 31 December 2021 was MNOK 13,618, which represents 34.6 per cent of total assets. Net interest-bearing debt (interest-bearing debt minus cash) was MNOK -5,668. At year-end, long-term interest-bearing debt mainly consisted of four long-term bonds totalling MNOK 2,450.

The Group’s syndicated loan facility of MNOK 2,300 was unused at the end of 2021.

KONGSBERG has historically experienced substantial fluctuations in working capital due to different payment structures for major projects in KDA. This situation is expected to continue.

Foreign currency

The Group’s financial policy stipulates that contracts over a certain size must be hedged upon establishment, and these are largely hedged using currency forward exchange contracts (fair value hedges). In special cases, the Group uses forward contracts and options as cash flow hedges, for example in the case of large tenders where there is a high probability of winning the contract. The Group uses hedge accounting for established forward contracts, which means that changes in the value of hedging instruments and objects are capitalised.

At the end of 2021, the balance of forward contracts related to fair value hedges was MNOK 13,968 measured at the agreed rates. These forward contracts had a net fair value of MNOK 188. In addition, the group had net sales of currency equivalent to MNOK 15 as cash flow hedges measured at agreed exchange rates, consisting of forward contracts. At year-end, these forward contracts had a net positive fair value of MNOK 37.

Outlook for 2022

In recent years, KONGSBERG has performed positively and shown that we are able to adapt to significant and rapid changes. The unpredictability of the COVID-19 pandemic has forced us to think differently and resulted in a number of changes and transitions. There is still uncertainty associated with the pandemic. We still need to plan for indirect effects such as travel restrictions, quantity restrictions and challenges within logistics and components. This will continue to affect our working methods and will require vigilance and coordination in the future.

The company’s order backlog increased by NOK 13.6 billion during 2021. Out of the total order backlog, NOK 19.9 billion will be delivered during 2022. This gives order coverage of NOK 2 billion greater than it was at the start of 2021. Order intake from the aftermarket is included in the order backlog to a minor extent. The order backlog for associated companies as well as framework agreements are in addition to the reported order backlog. There is a good basis for further growth in 2022.

Kongsberg Maritime’s markets have been challenging throughout the pandemic. There are still certain challenges, especially relating to access to and delivery time of certain components. At the same time, contracting of new vessels rose in 2021. The order reserve at the start of 2022 is NOK 13 billion, of which NOK 8.5 billion is for delivery in the current year. This provides a foundation for growth in 2022. KM has carried out considerable measures to adjust cost levels in recent years. This, together with general efficiency measures, means that the business area is on track in terms of its current margin target.

Kongsberg Defence & Aerospace has largely maintained operations at an almost normal level throughout the pandemic. The year 2021 saw records set for new contracts and the business area entered the new year with an order backlog of NOK 36 billion, of which NOK 11 billion is for delivery in 2022. The growth rate from last year is, therefore, expected to continue. The project mix on which it is delivered is an important factor for the profitability of the business area. The projects that will contribute most to operating revenues in 2022 will largely be the same as in 2021 and profitability is therefore expected to remain at a good level.

Kongsberg Digital increased the number of installations of both Kognitwin and Vessel Insight systems in operation in 2021, and there is great market activity and increased demand for the business area’s solutions. It is expected that the proportion of recurring revenues will increase to about 50 per cent in 2022. However, as a result of significant continued investment in increased capacity, development and the roll-out of digital solutions, negative EBITDA and cash flow are expected from the business area. KONGSBERG has great ambitions for KDI and the business plan for the area is targeting a turnover of NOK 2.8 billion in 2025.

Overall, KONGSBERG expects revenue growth and is on track to reach its targets for 2022.

Future strategy and priorities in 2022

KONGSBERG is a global technology company that supplies systems and solutions with extreme performance for extreme conditions. KONGSBERG’s deliveries are often of great strategic importance for our customers, and contribute to the satisfaction of important sustainable societal needs and development trends within defence and security, energy, transport, climate and the environment. Our technology contributes to making critical operations for sustainable future solutions possible.

KONGSBERG’s focus is to ensure the company’s competitiveness, while also laying the foundations for sustainable and profitable growth. The company has an active and dynamic approach to the management and evaluation of its entire portfolio and has a clear strategic goal of maintaining a leading position in innovation and technology development within the Group’s core areas. Our business culture is characterised by high ethical standards and integrity, and this forms the basis for our strategic decisions and business choices.

Growth will come from the development and expansion of existing products, services and solutions, as well as the development of new products for new markets.

In addition, acquisition opportunities are continuously assessed in accordance with KONGSBERG’s strategic direction, to increase the company’s potential to create value. The Group will contribute to a greener and more sustainable society, including through the development of systems, digital tools and processes to increase efficiency. KONGSBERG will develop a competitive edge by taking a leading role within sustainable innovation.

One important priority for KONGSBERG is to ensure that all business areas have the necessary resources and capacity to facilitate delivery that matches the company’s strategic ambitions. Employee involvement, leadership development, a strong culture, diversity, and opportunities for continuous training and development are areas of great importance for KONGSBERG to continue to be an attractive employer that is well positioned to retain and attract highly skilled and dedicated people.

Kongsberg Defence & Aerospace

KONGSBERG has world-leading products and systems for the international defence market. Our advanced military products, solutions and services are designed to meet the needs of our customers in our niche markets. The main focus for KDA is to secure strategically important contracts and achieve growth in selected geographical regions and markets, both through our own activities and in collaboration with partners. KONGSBERG will also develop its position as a leading Nordic space company.

In 2021, KONGSBERG secured a number of important contracts that support our strategic priorities. Kongsberg Aviation Maintenance Services (KAMS) became the first authorised maintenance centre in Norway for the Bell 412 fleet, an important step in continuing the development of KAMS into a leading international provider of defence maintenance. The contracts for combat systems for German and Norwegian submarines and for NSM for both these two countries, confirms KDA’s position as the leading defence supplier in Northern Europe. KDA is also looking at opportunities to build on its presence in the US market. KDA is constantly working to identify opportunities to develop solutions for a more sustainable defence. The circular economy is an important area of focus, and activities prolonging the life of systems are also high on the agenda. The entire value chain, encompassing both customers and suppliers, is working closely to contribute to a green transition while safeguarding our societal mission within security and defence.

Kongsberg Maritime

Through KM, KONGSBERG occupies a leading position as an equipment and systems supplier to the maritime market. Efficient operations, safety and energy efficiency are key drivers for the further development of the KM product portfolio within the maritime market, both in existing and new markets such as offshore wind, environmental monitoring and seabed mapping. We will be a driving force behind the green transition and integrate operational efficiency and sustainability into all our products and services. We will improve our position in the upgrade market, especially in the delivery of hybrid solutions such as battery power. We are working closely with our customers and partners to improve the green footprint throughout the life cycle of a system. KM also continues to work on the harmonisation of its product portfolio and is implementing continuous measures to improve the efficiency of the business further. KM is part of the solution for the creation of a future sustainable marine environment and aims to be a technology leader in terms of both transport and resource utilisation.

Kongsberg Digital

KDI continued its progress in 2021 and is well positioned to become a key player in the digitisation of capital-intensive industries. Our ambition is to create a world-leading digital working platform. The business area has continued to invest and improve its capabilities in core business areas, and this has resulted in a significant increase in the number of users for both the ship-to-cloud solution Vessel Insight and the dynamic digital twin solution Kognitwin Energy. The phase that KDI now finds itself in means that it is natural to assess both future partner models and other models in order to fully realise the potential KONGSBERG sees in KDI, including a stock exchange listing.

The business areas’ priorities in 2022

Kongsberg Defence & Aerospace

- Ensure good implementation of the major ongoing defence programmes.

- Consolidate strategically important contracts.

- Maintain a position as a leading defence provider in Northern Europe.

- Further strengthen existing positions in the US.

- Further develop cooperation with Patria, and through KAMS develop into a strong, international player within military maintenance.

- Identify and develop sustainable solutions that both contribute to the green transition and safeguard our societal role in security and defence.

- Expand our deliveries within the space industry, for both the commercial sector and defence markets.

- Ensure international market opportunities and industrial cooperation related to Norwegian defence investments.

- Continuous work on efficiency measures.

Kongsberg Maritime

- Take advantage of our bridge-to-propeller portfolio and sales and service setup to maintain our position as a leading technology supplier to the maritime industry.

- Continue work on harmonising our product portfolio.

- Continue our product innovation, including concepts in digitisation, autonomy and green shipping.

- Improve profitability through continuous work on efficiency measures.

- Contribute to shaping the maritime future and positioning KM as the preferred supplier to important maritime sectors throughout the ocean space.

Kongsberg Digital

- Digitalisation of the maritime market through “Vessel Insight” in order to contribute to streamline the customers operations through utilization of available and simulated data.

- Ensure further development of KDI through focus areas such as “Dynamic Digital Twin” which contributes to increase the efficiency and security in complex operations.

- Contribute to innovation and digital transformation of the cloud-based platform “Kognifai” through collaboration with partners.

- Ensure that KDI has the necessary resources at its disposal to take up strong positions within priority sectors.

KONGSBERG shares and shareholders

KONGSBERG shall provide the equity market with relevant, comprehensive information as the basis for a balanced, correct valuation of the shares. The Group emphasises maintaining an open dialogue with the equity market and media.

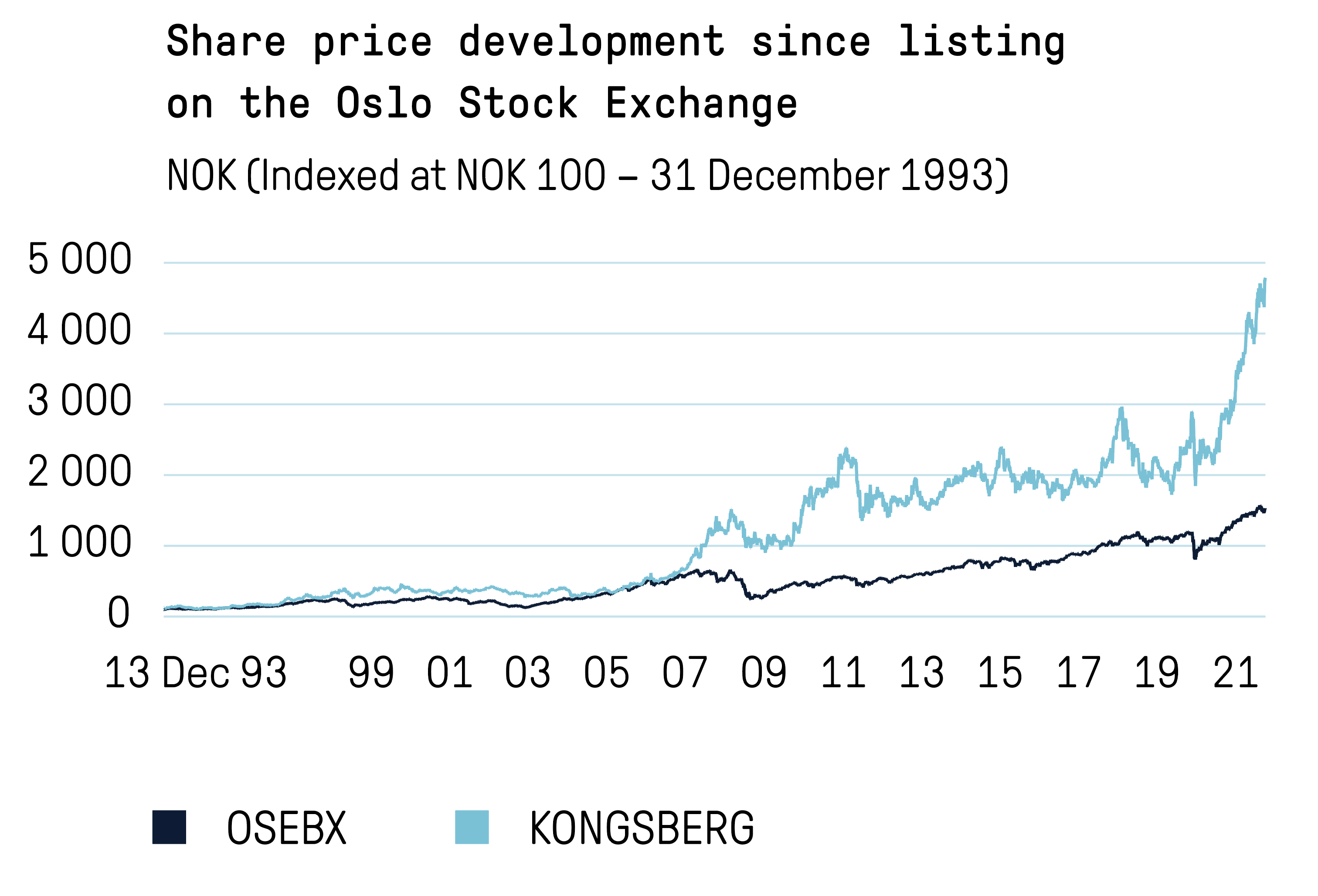

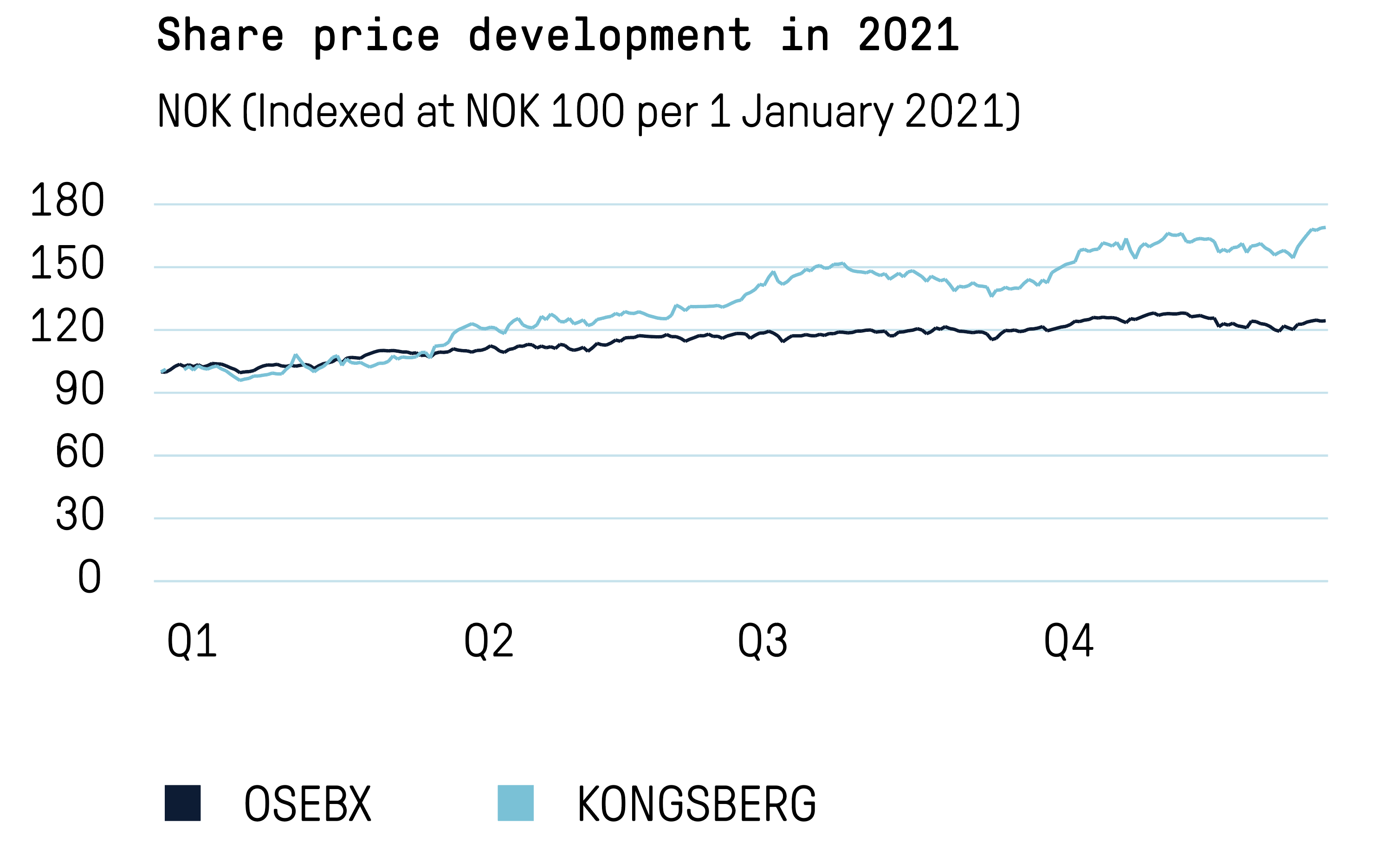

The price of KONGSBERG shares increased from NOK 176.20 at the end of 2020 to NOK 286.00 at the end of 2021. This gives a market value at the end of 2021 amounting to MNOK 51,146. Including a dividend of NOK 8.00 per share, the return in 2021 amounted to 66.9 per cent. The benchmark index on the Oslo Stock Exchange (OSEBX) rose by 23.4 per cent during the same period. As of 31 December 2021, KONGSBERG had 16,507 shareholders (14,678). The company had 943 (916) foreign shareholders who together owned 19.90 per cent of the shares (17.76 per cent). The Norwegian State, represented by the Ministry of Trade, Industry and Fisheries, is the largest shareholder with 50.004 per cent of the shares. At the end of the year, the ten largest shareholders held a total of 70.62 per cent (71.99) of the shares. The number of shares outstanding is 178.83 million, each with a nominal value of NOK 1.25. By the end of 2021, KONGSBERG held a total of 613,987 (191,387) treasury shares. Of these, 592,028 shares were related to a repurchase programme of up to MNOK 400, half of which were repurchased in the market. The remaining shares, up to MNOK 200, will be purchased from the State – that is, from the Ministry of Trade, Industry and Fisheries – in accordance with an agreement between KONGSBERG and the Ministry. The shares were repurchased under the authorisation given to the Board by KONGSBERG’s Annual General Meeting on 6 May 2021. KONGSBERG will ask the 2022 Annual General Meeting for approval to re-absorb shares repurchased under this programme.

KONGSBERG has paid dividends to its shareholders every year since the company was listed in 1993, except for in 2000 and 2001. The company’s dividend policy was changed in 2020. The current dividend policy reads: “KONGSBERG’s aim is to pay an ordinary dividend per share that is stable or growing from one year to the next. Additional dividends and/or repurchases of own shares can be used to supplement ordinary dividends. All payments to shareholders will be subject to the company’s assessment of future capital requirements.”

In 2021, a total of 31.8 million (66.4 million) KONGSBERG shares were traded in 174,154 (185,702) transactions. The company works actively to promote interest in the share through activities within the investor markets. KONGSBERG is regularly represented at road shows, meetings and conferences both in Norway and abroad. In 2021, this activity was mainly digital. The target for 2022 is a high level of availability and continued progress towards the investor market. Investor presentations are held in connection with each quarterly report.

The Board believes that employee share ownership is positive. Employees can buy shares in the company through the annual share programme. In the spring of 2021, the Group’s annual share programme for employees was carried out for the 25th time. Shares were sold to employees with a 25 per cent discount on the market price.

In 2021, employees were offered shares for up to NOK 71,961 after discount. Under this offer, 1,522,101 shares were sold at a price of NOK 198.66 per share (a 25 per cent discount on the average purchase price adjusted for the dividend). In total, 4,319 employees took advantage of the offer.

Risk factors and risk management

KONGSBERG is exposed to various forms of risk, which the Board monitors by considering individual matters and reporting risk to the Board. The Board is of the opinion that there is a healthy balance between the overall risk and the Group’s capacity to deal with risk. The administration prepares monthly operating reports and quarterly risk reports which are considered by the Board. The administration conducts risk analyses in connection with major investments and customer contacts, strategic initiatives and the acquisition and sale of activity. The Audit Committee is a preparatory body for the Board, dealing with the financial statements and relevant assessment issues, compliance issues, and the evaluation of internal control and risk management within the Group. The Audit Committee meets, as a minimum, in connection with the issue of annual and interim financial statements.

The Group’s activities are international with delivery of high-tech systems and solutions, primarily to customers within the maritime and defence markets. Market risk could therefore vary somewhat within these different segments. A strong international presence and global dependency mean the Group is vulnerable to factors that impact on international trade, currency and the global economy generally.

The ongoing COVID-19 pandemic means a certain degree of uncertainty for the whole value chain in the future, given travel restrictions, quarantine regulations and other anti-infection measures, as well as the flow of inputs and finished products. As long as the pandemic is ongoing, we must expect continued uncertainty in some markets, and recognise that a resurgence of infection rates could adversely affect activity levels. A major outbreak at KONGSBERG could also lead to periods of lower activity and delays in deliveries to customers. The group has implemented and will continue to implement new preventive measures in accordance with the relevant authorities’ applicable guidelines. This is to protect our own employees and business connections and, as far as possible, ensure normal operations. After almost two years of COVID-19, KONGSBERG has had many experiences that will be valuable in managing the COVID-19 pandemic in the future, as well as any future pandemics and other emergency situations.

When preparing the annual accounts, assessments have been made with consideration given to possible COVID-19 impacts on the accounting items. Lower activity among customers and suppliers, travel restrictions and an increased risk of delays to projects as a result of temporary closures and a lack of inputs will affect sales, profits and order intake. Furthermore, there is also a greater risk of cancellation of customer contracts and delayed or absence of payments as a result of a large section of the customer base being affected. This in turn could lead to an increased risk of losses on receivables, goods, project assets and currency futures. In 2021, the Group has had only limited losses and write-downs.

At the end of 2021, there was increased political tension between Russia and Ukraine, and in February 2022 the situation escalated with the Russian invasion of Ukraine. The conflict is affecting the flow of energy and goods between the two countries and the rest of the world, and in 2022 broad sanctions were implemented. This will also affect KONGSBERG, and as such the situation is being closely monitored.

The offshore market comprises exploration, development, production and transport of oil and gas. There are also support functions such as supply services, operational support, as well as maintenance and service on platforms and vessels. KONGSBERG is a supplier of products and services for all these segments. The demand for energy and oil price development will impact the willingness to invest in this market. Investment levels can also vary between the various geographical areas depending on, for example, oil reserves and the level of exploration and production activities. Despite strong development in individual segments such as LNG, there has generally been a negative trend in the oil and gas and offshore markets in recent years. A persistently weak environment, in which markets that have been strong over the past year are also being affected, will increase the Group’s risk and may impact on its activity levels. The uncertainty surrounding future developments in oil prices affects investment levels in several segments, while at the same time providing opportunities in other segments where KONGSBERG’s technology can make a difference. Throughout 2021 there has also been a further increase in the focus on sustainability. This affects investors and lenders in their assessments and could further affect KONGSBERG and our customers’ and suppliers’ activities and priorities in the future.

The merchant marine market includes all types of vessels from simple dry cargo ships to advanced tankers. Passenger ships in cruise and ferry traffic are also an important part of the market. Contracting of new ships is closely linked with the expected development in transport demand. Global economy development influences the demand for water transport of people, energy, raw materials and manufactured products. The type of ship and geographical areas also influence the market. Within a number of segments, the market for new-build vessels is at a low level compared with previous years, and there is considerable uncertainty linked to further development in the short- to mid-term.

Reduced shipbuilding activity has led to an increase in competition. More challenging oil and gas fields, increased sustainability requirements and significant focus on costs in the industry in general create new opportunities in the market, which in turn creates the need for new technological solutions. Through the acquisition and integration of RRCM, the Group has expanded KM’s delivery scope, thus reducing the risk of marginalisation and improving its position in the market.

The acquisition of RRCM in 2019 was a significant transaction for the Group, and it has been crucial to integrate the business into KM successfully and quickly. KONGSBERG has succeeded in this and has largely implemented the planned restructuring of the company to the extent that RRCM is now an integral part of KONGSBERG. The Board of Directors considers that the risk arising from the acquisition has now passed.

Products and systems are delivered for land-, air- and seabased defence in the defence market. Due to strict security requirements and protection of various countries’ own defence industries, it is often difficult for defence suppliers to win defence contracts outside their home country. There is a significant degree of protectionism in Europe and the US, as well as in the defence market in general. However, there are still opportunities through long-term relationships and niche products, and this is partially safeguarded through KONGSBERG’s relationships with a number of major foreign defence companies.

KONGSBERG mainly operates in markets that are highly susceptible to technological developments, ones that may affect KONGSBERG’s leading position with regards to technology. In order to take new market positions and maintain existing ones, significant funds are used annually to develop both new and existing products. Cyclical fluctuations will also influence the markets to various degrees and at different points in time. Export control regulations and sanctions may result in uncertainty in terms of market opportunities. In 2021, attention on the restriction of exports of technology products through export control regulations has continued, and combined with the ongoing trade war between the US and China, the risk linked to restrictions on market access and sanctions is at the same level as in 2020.

The Group delivers systems and solutions of high technological complexity, and the deliveries are typically organised as projects. Effective project management is therefore a key success factor in reducing operating risk. KONGSBERG has established project management goals based on internal and external “best practices”, and project managers attend training programmes. Project revenues are largely based on contracts, and the uncertainty is largely related to estimating the remaining costs and determining the percentage of completion, but also counterparty risk and warranty obligations. The Group has established principles for categorising projects in terms of technological complexity and development content. This forms the basis for an assessment of implementation risk and recognition of revenue in the projects.

KONGSBERG is exposed to financial uncertainty through currency risk, interest risk, credit risk and liquidity risk. The aim is to reduce financial risk and, through this, improve predictability within the Group. KONGSBERG’s financial risk is managed centrally by guidelines for financial risk management adopted by the Board and included in the Group’s financial policy. The Group’s financial risk management is described in Note 5 to the financial statements, “Management of capital and financial risks”. The Group has a diversified customer base, mainly comprising public sector institutions and larger private companies in numerous countries. Historically, the Group has had low losses on receivables. Measures to limit the risk exposure are implemented continuously where the administration deems it necessary. The Group’s liquidity risk is managed centrally through the refinancing of loans and available capital, as well as the use of liquidity prognoses.

With a high proportion of net income in currencies other than Norwegian kroner, KONGSBERG is exposed to fluctuations in foreign exchange markets. We seek to reduce currency risk through the exercise of the group’s financial policy, which states that contracts above a certain size must be hedged upon signing. These are mainly hedged using forward exchange contracts (fair value hedges). In special cases, the Group uses forward contracts as cash flow hedges, e.g. in the case of large tenders where there is a high probability of winning the contract.

KONGSBERG has recognised substantial book values in the balance sheet which are justified by future cash flows. Any reduction in cash flows may affect the value of the assets. In 2016, KONGSBERG purchased 49.9 per cent of the shares in Finnish company Patria, which had a book value of MNOK 2,846 on 31 December 2021. Patria’s results were poor in the periods after the acquisition but have shown a clear improvement in the last two years. A persistent deterioration in Patria’s results could mean that it will be challenging to defend the book values.

Deferred tax benefits have also been reported based on tax losses dependent on future tax earnings in order to be utilised.

KONGSBERG has for several years established and developed compliance functions. Regulations, as well as monitoring and reporting systems, are established for managing risks related to areas such as anti-corruption, export controls and sanctions, supply chains and whistle-blowing. Training within the area of ethics and compliance is carried out in the entire organisation, both in Norway and abroad.

We carry out external evaluations of our compliance and anti-corruption programme every three years, with the last occasion being in 2020.

The Board considers KONGSBERG’s compliance programme to be at an extremely good level.

As a high-tech company, KONGSBERG is constantly exposed to threats associated with data security and is under constant pressure from different external players. In essence, it is at risk from data virus attacks, attempts at hacking, social engineering and phishing scams. Executive management prioritises and pays close attention to monitoring and other measures to prevent being compromised. To be as well equipped as possible against this type of threat, KONGSBERG has established the Kongsberg Cyber Security Center, and works closely with the National Security Authority and a number of leading competence environments. This, together with providing employees with information and training, helps to ensure that the Group continuously improves its ability to withstand these threats. In 2021, KDA, representing KONGSBERG, became a member of FIRST (Forum of Incidence Response and Security Teams). FIRST is an Internet security forum that helps global coordination by providing information, platforms and tools to find the right partner and promote effective collaboration.

Technology and product development

KONGSBERG develops and delivers high-tech solutions nationally and internationally. KONGSBERG’s technology platform has been systematically built up through many years and is an important factor in our competitiveness. Technology transfer between the different parts of the Group is significant. Sustainable innovation is an important aspect of the Group’s business strategy and future-oriented technology expertise in digitisation has been built up and invested in. We are also working with our main technology partners to further develop our technology platform. KONGSBERG continuously invests in product and system development, both internally financed and through customer-funded programmes. In total, the group spends about ten per cent of operating revenues on product development.

Sustainability and ESG

KONGSBERG shall represent sustainable development characterised by a sound balance between economic performance, value creation and environmental, social and governance (ESG) aspects. Sustainability and ESG are integrated into the Group’s strategy processes. Sustainable innovation is a central element in contributing towards solving the major global challenges the world faces. For KONGSBERG, this means business opportunities in several markets viewed in the light of our broad technological and skills platform. We are conscious of the risk associated with our “licence to operate”, both in terms of compliance with laws and regulations as well as development in terms of resource scarcity, world turmoil, developments in global megatrends and similar. KONGSBERG has, and will continue to have, a focus on anti-corruption and corporate social responsibility in our suppliers and partners, as well as on the follow-up of human and workers’ rights, both in our own organisation and with our business partners. A more detailed description of the Group’s work on sustainability and ESG is given in the chapter in the annual report on corporate responsibility.

Ethics, integrity and compliance

In carrying out all activities, we are committed to living up to our values and high safety, ethical and quality standards, which are also reported on in our quality management system. The Board believes that such a commitment is fundamental to a healthy, successful and sustainable business. Significant resources are dedicated to maintaining a comprehensive global ethics and compliance programme that is designed to prevent and deter, and to detect and manage any violations of laws, our business ethics guidelines and other important company regulatory and governance documents.

Climate and environment

The climate and environmental statement provides an overview of KONGSBERG’s consumption of energy, CO2 emissions and waste processing. The Group’s most significant positive contribution in terms of climate challenges is through our deliveries of products and solutions that in various ways play a part in reducing emissions for our customers. This is central to our business strategy.

In 2021, the Group committed to setting targets to reduce emissions from our own activities, including our supply chain, according to the Science Based Targets initiative. The objectives are described in the environment chapter of this report. Here you will also find a detailed overview of the climate and environmental accounts for 2021. Our ambition for the 2022–2030 period is to reduce our own climate emissions from the use of oil and gas by 50 per cent and from internal electricity consumption by 25 per cent in energy efficiency and technical upgrades. Furthermore, electricity purchases from renewable energy sources will have guarantees of origin. We will reduce emissions from transport and distribution by 25 per cent and from our own business trips by 30 per cent. In addition, our ambition is for at least two-thirds of our suppliers to set their own Science Based Targets for their businesses within five years.

No serious incidents related to environmental pollution were reported in 2021.

Health, safety and the environment

KONGSBERG’s vision for health, safety and the environment (HSE) is zero incidents or accidents involving our employees, visitors, customers and partners in our global operations. In order to achieve this vision, we never stop working to build a strong, proactive HSE culture.

At KONGSBERG, safety must always come first, and our employees and partners are instructed to stop work if it involves a safety risk. We believe in cooperation where we all have personal responsibility and work together for the basic principle that HSE work should be preventive. The importance of this was further emphasised during the COVID-19 pandemic.

A global HSE campaign was rolled out in 2021 to increase focus on well-being via the year’s “Global HSE day”.

Ongoing HSE activities are performed in all business areas to prevent undesirable incidents, and good HSE practice is shared between business areas.

We place emphasis on the increased reporting of near-accidents, high-risk incidents and HSE observations, and these measures will contribute to reducing the number of injuries and accidents. On this basis, KONGSBERG has decided to introduce a central HSE reporting system for the whole Group. In this way, we can learn from each other and encourage suggestions for improvements throughout the organisation.

The number of occupational incidents with and without absence (“TRI”) rose from 1.67 in 2020 to 2.23 in 2021. The majority of personal injuries are related to falls with a limited degree of injury. Preventive measures are introduced on an ongoing basis.

Extensive use of homeworking has meant that different digital learning platforms have been used to provide training at times when attending the workplace in person has not been possible.

Total sick leave in the group increased from 2.9 per cent in 2020 to 3.0 per cent in 2021.

For activities in Norway, absence due to illness stands at 3.2 per cent, at the same level as 2020. The COVID-19 pandemic has had a certain impact on sick leave, especially in situations where employees have been required to quarantine without access to their own work tasks. There is systematic follow-up of employees on sick leave, particularly in terms of getting long-term absentees back to work. Further details about key sustainable figures for HSE are found in the Group’s report on sustainability.

All employees in Norway have access to company health services. This varies in accordance with local practices and legislation in our foreign business activities. At the end of 2021, 37 per cent of KONGSBERG’s employees were based outside Norway. This requires additional attention and insight with respect to HSE issues in the countries in question.

The Board is closely monitoring the work by reviewing HSE reports quarterly.

Geographical distribution of revenues

Per cent- Norway 19 %

- Rest of Europe 27 %

- Central and South America 2 %

- North America 29 %

- Asia 20 %

- Australia 2 %

- Africa 1 %

Geographical distribution of employees

Per cent- Norway 62.63 %

- Rest of Europe 18.18 %

- Central and South America 1.01 %

- North America 5.05 %

- Asia 12.12 %

- Other* 1.01 %

*) Australia og Afrika

Our employees

|

Number of employees

|

Number of employees

|

31 Dec 21

|

31 Dec 20

|

|---|---|---|---|

|

Kongsberg Defence & Aerospace |

Kongsberg Defence & Aerospace |

3 428

|

3 189

|

|

Kongsberg Maritime

|

Kongsberg Maritime

|

6 857

|

6 815

|

|

Other

|

Other

|

837

|

685

|

|

Total in the Group

|

Total in the Group

|

11 122

|

10 689

|

|

Proportion outside Norway

|

Proportion outside Norway

|

37%

|

38%

|

KONGSBERG has a unique and strong corporate culture that has been developed over many years. Our culture is a valuable resource, helping us to attract people with the right behaviours and skills to meet the technical challenges of the future in a sustainable way. In 2021, we highlighted typical KONGSBERG behaviours – our vision, common values and group identity. Sound and clear shared values deliver good practices that produce business results. KONGSBERG has clear common denominators and these are expressed and experienced in the same way no matter where we work.

The value of collaboration is fundamental to our business. The “Collaboration Award” is an award given to recognise groups and projects where collaboration has been crucial to successful results. In 2021, the prize was awarded for the fourth time, and the winner was the Ubåtprosjektet (Submarine project) 212 CD capture team project. The project is a collaboration between Kongsberg Defence & Aerospace, kta naval systems, ThyssenKrupp Marine Systems and Kongsberg Maritime.

Leadership at KONGSBERG is about creating value and achieving results through people. The key to success lies in the combination of good management and dedicated employees. Managers shall exercise their leadership based on our values, the Corporate Code of Ethics and management principles. Our managers must create an environment in which our employees will prosper and succeed in meeting the strategic priorities of customer satisfaction, innovation and operational excellence. On the basis of this, we have implemented a management development programme, Leadership@KONGSBERG, that will contribute to clarifying and quality-assuring processes for goal-setting, follow-up and evaluation. In 2021, a high proportion of our employees worked from home due to COVID-19, and we have therefore prioritised the close follow-up of employees and clear leadership.

An important condition for long-term success is that KONGSBERG properly manages employee competencies. The Group is aiming to increase the exchange of knowledge and staff between the business areas. Good work processes and development opportunities are important incentives in recruiting and retaining good employees. KONGSBERG places emphasis on strengthening competences and is continuously working to develop its employees. Among KONGSBERG employees, 62 per cent have college- or university-level education.

The Group educates skilled workers within several disciplines in cooperation with the education company Kongsberg Technology Training Centre AS, partly owned by KONGSBERG. During 2021, we had 196 apprentices. The Group also facilitates and stimulates employees to acquire apprenticeship completion certificates as private candidates, known as practice candidates.

Cooperation with employee unions and organisations through established cooperation and representation arrangements are well functioning and constitutes valuable contributions in meeting the Group’s challenges in a constructive manner.

Diversity

|

Key figures in diversity

|

Key figures in diversity

|

31 Dec 21

|

31 Dec 20

|

|---|---|---|---|

|

|

|

|

|

|

Percentage of women

|

Percentage of women

|

20.4

|

20.1

|

|

Percentage of women in managerial positions out of total managerial positions

|

Percentage of women in managerial positions out of total managerial positions

|

19%

|

19%

|

|

Percentage of

women in level 1–3 managerial positions out of total managerial positions |

Percentage of

women in level 1–3 managerial positions out of total managerial positions |

25%

|

23%

|

|

ercentage of women in corporate executive management

|

ercentage of women in corporate executive management

|

22.2%

|

25%

|

|

Shareholder-elected women on the Board

|

Shareholder-elected women on the Board

|

40%

|

40%

|

KONGSBERG remains convinced that diversity benefits our business, provides access to a wider range of talent and ensures better and wider understanding of customers, as well as access to new markets. Different perspectives drive innovation and growth. This is why we work systematically and purposefully to recruit and develop people of different ethnic backgrounds, ages and genders.

The company considers it important to promote gender equality and prevent discrimination in conflict with the Gender Equality Act. Long- and short-term goals have been established to help increase the percentage of women in the Group, both in terms of employment and in terms of management positions.

As far as is possible, KONGSBERG tries to adapt working conditions so that individuals with diminished functional abilities can work for the Group. The Board Compensation Committee has a particular responsibility for follow-up on diversity. In the opinion of the Board, the Group complies with current regulations.

See "Health, safety and the environment, and people" of this report for more details on the Group’s work on diversity and equality.

Corporate governance

KONGSBERG’s objective is to secure and increase stakeholder value through profitable and growth-oriented industrial development with a long-term, sustainable and international perspective. Good corporate governance shall reduce business-related risk, while the company’s resources shall be utilised in an effective and sustainable manner. Values created should benefit shareholders, employees, customers and society in general. The Board considers it important to review and update the Group’s corporate governance documents annually to comply with the “Norwegian Code of Practice for Corporate Governance”.

According to Section 3-3b of the Accounting Act, the company shall prepare a statement on corporate governance. The statement will, pursuant to Section 5-6 of the Public Limited Companies Act, be discussed at the Annual General Meeting. The description in chapter 4 of the annual report is based on the latest revised version of the Norwegian Code of Practice for Corporate Governance of 14 October 2021.

Board liability insurance

Kongsberg Gruppen ASA has taken out board liability insurance for the Group’s Board members, CEO and executive management. The board liability insurance covers legal financial claims against the Board or executive management arising from actions by the Board or executive management. The insurance applies to all KONGSBERG subsidiaries in which KONGSBERG has a holding of more than 50 per cent. The insurance has been taken out with respected insurance companies with good ratings.

Remuneration to executive management

The Board has a separate Compensation Committee which deals with all significant matters related to remuneration for Executive Management before the formal discussion and decision by the Board. In accordance with Norwegian equity legislation, the Board of Directors has also prepared a separate “Report on the remuneration of executive management at KONGSBERG for 2021”, which will be published along with the invitation to the Annual General Meeting.

Profit for the year and allocation

The parent company Kongsberg Gruppen ASA made a net profit of MNOK 5,782 in 2021. The Board proposes the following allocation of profit for the year in Kongsberg Gruppen ASA:

|

Dividend

|

Dividend

|

MNOK

|

2 736

|

|---|---|---|---|

|

To equityy

|

To equityy

|

MNOK

|

3 046

|

|

Total available

|

Total available

|

MNOK

|

5 782

|

The proposed dividend constitutes 119.5 per cent of the Group’s ordinary profit for the year.

Going concern

In compliance with Section 3-3a of the Norwegian Accounting Act, it is confirmed that the going concern assumptions continue to apply. This is based on forecasts for future profits and the Group’s long-term strategic prognoses. The Group is in a healthy economic and financial position.

Kongsberg, 16 March 2022