KONGSBERG will contribute to the green transition

Climate risk and opportunities

The climate is changing. If society does not succeed in reducing climate gas emissions and limit global warming in line with the Paris Agreement, there will be challenges – also affecting business. KONGSBERG’s ambition is to be a robust company that is well prepared for the future.

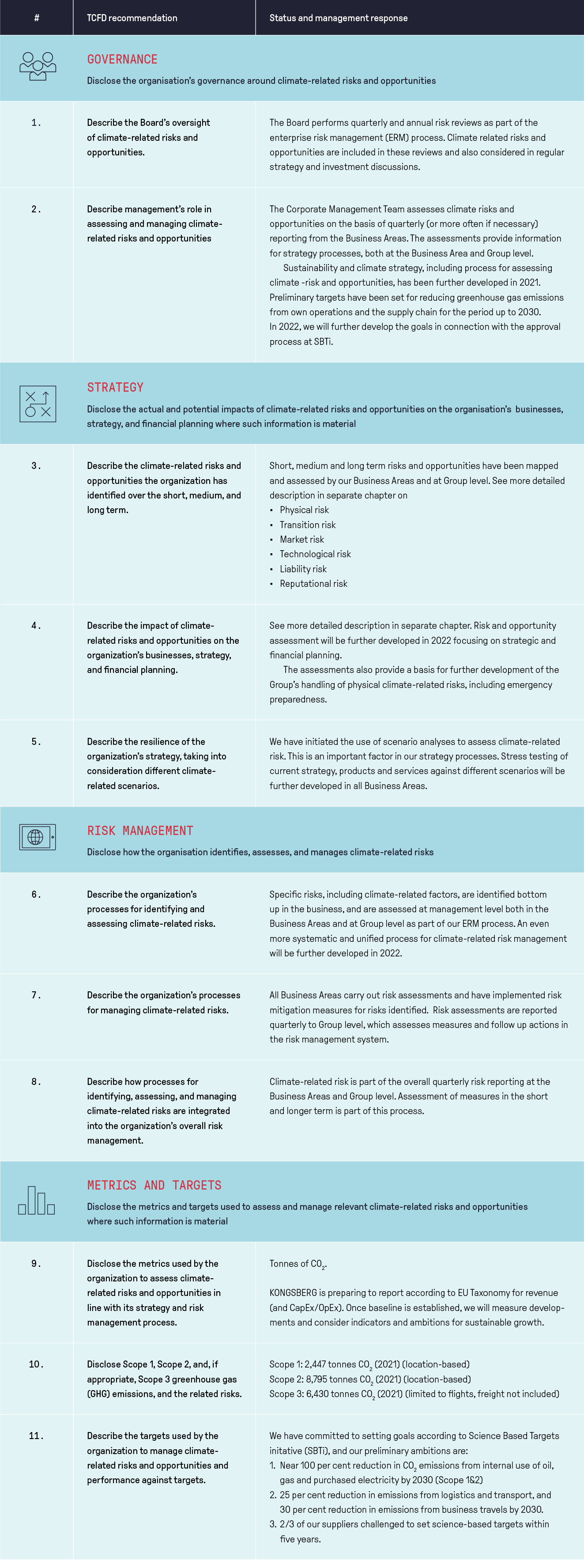

KONGSBERG started a project in 2020 to identify and manage climate-related risks and opportunities for the company, based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Based on this, in 2021 we further developed both our risk process and our strategy work to include climate considerations more systematically. We will continue this in 2022, with an emphasis on stress-testing our business strategy against various scenarios, quantifying possible financial impact and reporting relevant information to our stakeholders. An overview of climate-related risk factors and how we manage both the risks and opportunities associated risks follows below.

Physical risk

The chance of physical risk in our own business as a result of climate change is considered relatively low. We have thoroughly surveyed production sites and offices and have relevant safety measures and alternative supply lines in place for locations that could be affected by extreme weather events. We have Property Damage and Business Interruption Coverage (PDBI) insurance in place, which covers risks adapted to our exposure in the different locations around the world in which we operate.

Transition risk

We have ascertained that transition risk – the financial risk associated with the transition to a zero-emissions society – is low to moderate for KONGSBERG.

Market risk

A relatively high proportion of KONGSBERG’s turnover in the maritime sector is related to oil and gas activities, which are exposed to risks related to the tightening of climate-related regulations and changes in the market. This may affect segments such as the cruise industry. KONGSBERG is exposed in these markets, but over the last ten years we have expanded our delivery volumes considerably, both in terms of the markets we supply to and the products and systems we deliver. For example, Kongsberg Maritime’s products and systems contribute to a significant reduction in emissions for the units on which they are installed. To help our customers mitigate this risk, we make significant investments in the product development of innovative, low-emission solutions.

This requires flexibility and the ability to adapt to market developments. KONGSBERG considers this to be an opportunity, as we deliver competitive, flexible solutions that meet customers’ demands and expectations in terms of sustainability.

Technological risk

New technology can disrupt the market and lead to rapid changes. This may involve technological and market opportunities, but also risk if the company is not adaptable and cannot act quickly. We work closely with our customers and research environments to remain at the forefront of the development of technology. One of our strengths is our offering of flexible and adaptable systems and products that can quickly adapt to changes in demand. KONGSBERG is committed to delivering competitive technology that responds to the market’s increasing demand for low-emission products and services. Read more about this in the chapter “Sustainable innovation”.

Regulatory risk

Changes in climate policy can lead to changes in circumstances. One available measure is making it more expensive to pollute through increased taxes on greenhouse gas emissions. Our production is not energy-intensive, and our direct emissions are low. An increase in the carbon price is thus not seen as posing a significant financial risk to the company. Regulatory changes, particularly in the shipping sector (IMO, EU ETS, Fit for 55), may lead to increased demand for our zero-emission products and represent opportunities for profitable growth.

Supply chain

Scarcity, and in the extreme consequence unavailability, of raw materials required in the transition from fossil fuels to electricity may constitute a market risk. Higher overall energy prices will result in higher prices for raw materials and transport.

An emerging trend in many countries is increasing demand for local production and short supply lines, which may involve both opportunities and risks that need to be considered in the context of the price of raw materials, the possibility of flexibility in moving production, transport options etc.

During the COVID-19 pandemic, the vulnerability of the value chain has been tested and we have managed to maintain deliveries to our customers through active management of the supply chain and logistics across the enterprise.

Liability and reputational risk

The risk of potential claims for damages linked to decisions or non-decisions that are connected to climate policy or climate change, is considered low. This also applies to reputational risk, which can affect companies who are considered to have contributed to climate change or have not done enough to limit the effects of climate change. Our contribution and role in overcoming the climate challenge is seen as important and essential for the recruitment and retention of talented and committed people.